In this article, I would like to propose to capitalise on Kuwait’s relatively cheap Levelised Cost of Energy of PV Solar and Wind to produce Green Hydrogen and kickstart a green heavy industries hub in Kuwait to export green Steel, Ammonia, & Cement.

Whether we like it or not, demand for low emission products is set to rise in the near future and the opportunities at hand right now require abrupt actions for Kuwait to be able to expand its economy in tandem with the Oil and Gas Industries.

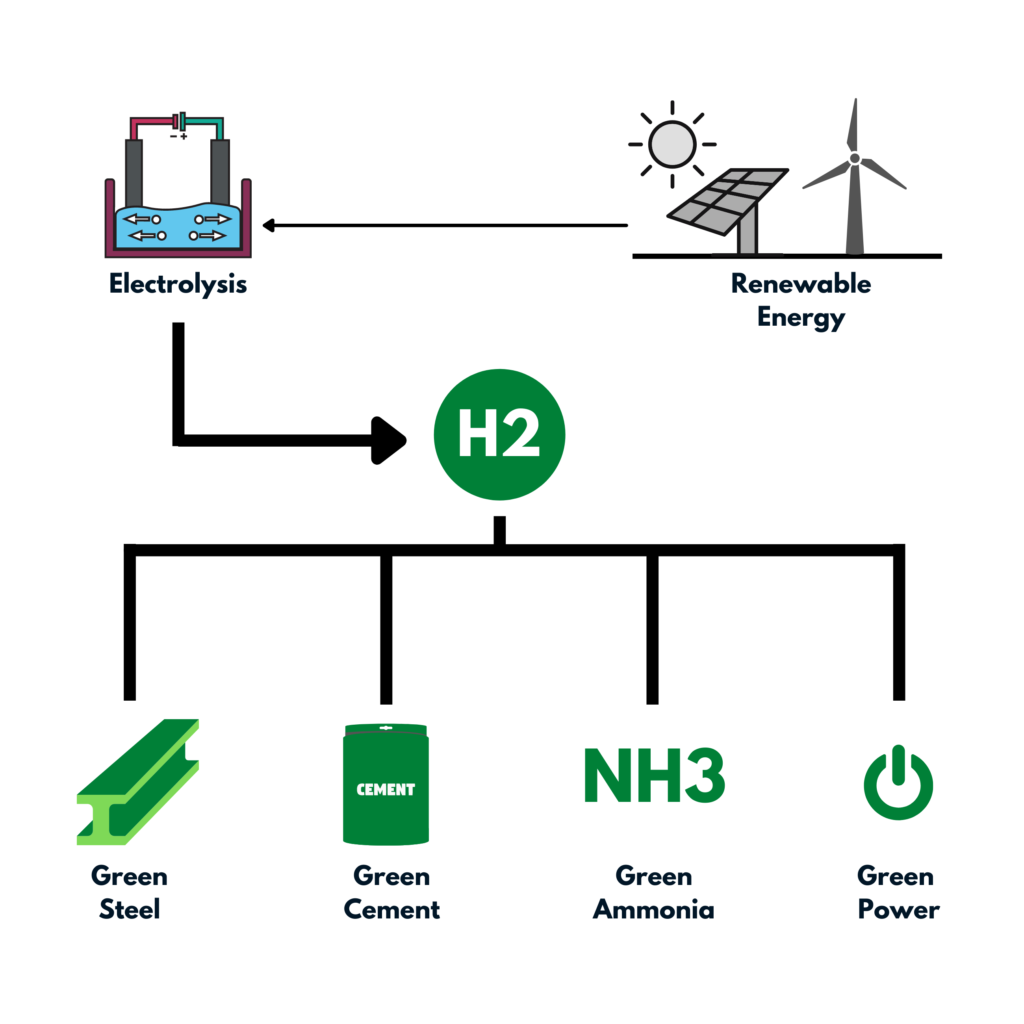

Green Hydrogen

Green Hydrogen is produced via electrolysis from renewable sources, like Solar or Windpower. (For more information read my primer on Hydrogen Energy)

Over the coming 40 years, power generation will shift more and more towards renewable sources of energy. Unfortunately for us, these sources are readily available around the world, for example, Hydrogen is available in any body of water. Therefore, the competition for the sale of an energy vector, like Green Hydrogen, will depend more on the following factors:

- The overall capacity of production

- Cost of renewable energy

- Efficiency & cost of production, storage, and shipping of Hydrogen

A country’s ability to stay relevant in the future Hydrogen economy is by providing the cheapest and most durable supply chain to its customers. Also, the industrial nations will produce their own hydrogen, but they will be constrained by capacity and cost. If Kuwait can provide Green Hydrogen to the international market at a competitive rate, then it will thrive in this sector.

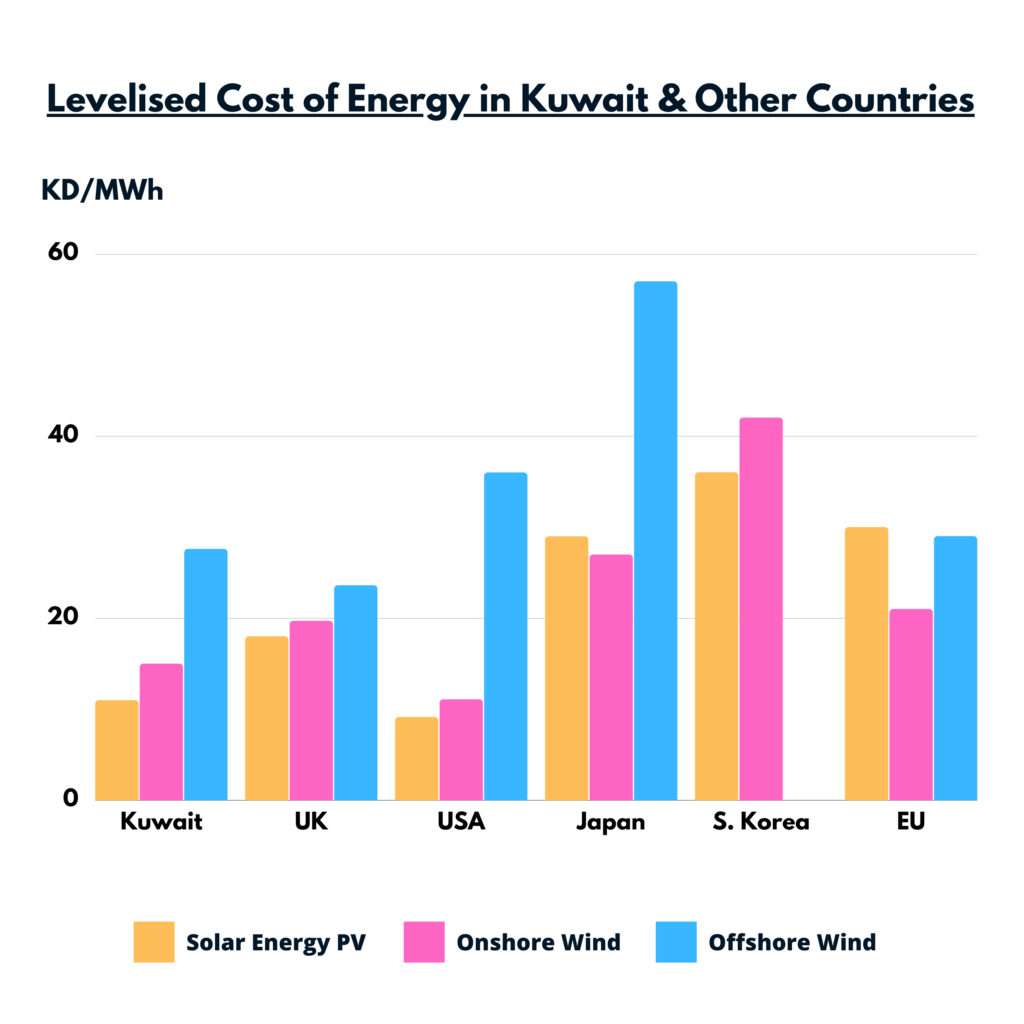

According to KISR, electricity produced from Kuwait’s conventional powerplants costs 39 KD/MWh, while power generated from Wind costs 15 KD/MWh. The lowest bid for phase 2 of Shagayaa PV was 11 KD/MWh. These electricity costs are low even for small-sized projects and yet they are lower than our counterparts in Europe and certain projects in the United States.

Green Hydrogen for Heavy Industries

As OECD countries increase their restrictions on industry-related emissions, heavy industries will try to reduce and eliminate their emissions, even the emissions generated by their suppliers.

Furthermore, the demand for the products mentioned below will increase heavily as they are essential for Electric Vehicles and other essential Energy Transition products.

Steel Industry

Major car manufacturers, such as BMW and Volvo, are working with their steel suppliers to eliminate emissions altogether from their supply chain. Kuwait can invite major steel manufacturers through public/private partnerships and reduce/eliminate their emissions by supplying them with cheap Green Hydrogen.

The emission elimination can be achieved using Electric Arc Furnace with Direct Reduced Iron. According to Mckinsey, a 2 million ton of Green Steel requires 114,000 tons/year of Green Hydrogen.

Cement Industry

Cement manufacturing is one of the most polluting industries in the world, with 40% of the emissions coming directly from burning fossil fuels in the manufacturing process. Kuwait can provide cheap Green Hydrogen to international cement manufacturers, in addition to investing in Carbon Capture & Utilisation technologies to capture the remaining CO2 and mix it with Hydrogen to create recycled Methanol, which can be used to power the green industry here.

Green Ammonia

Green Ammonia is produced by blending Green Hydrogen with Nitrogen, and it can be liquidated and stored and requires less energy to do so than Natural Gas. It is used to make fertilizer and in the pharmaceuticals, textiles, and refrigeration industries. Additionally, it could be used in Hydrogen Fuel Cells in vehicles or combusted in specialised turbines to produce electricity.

Currently, Japan and South Korea are aiming to produce more Hydrogen-powered vehicles, which makes those two countries the perfect customers for Kuwaiti Hydrogen. Also, countries that aim to reduce the carbon footprint in the agriculture sector will be the perfect candidates for Kuwait’s Green Ammonia.

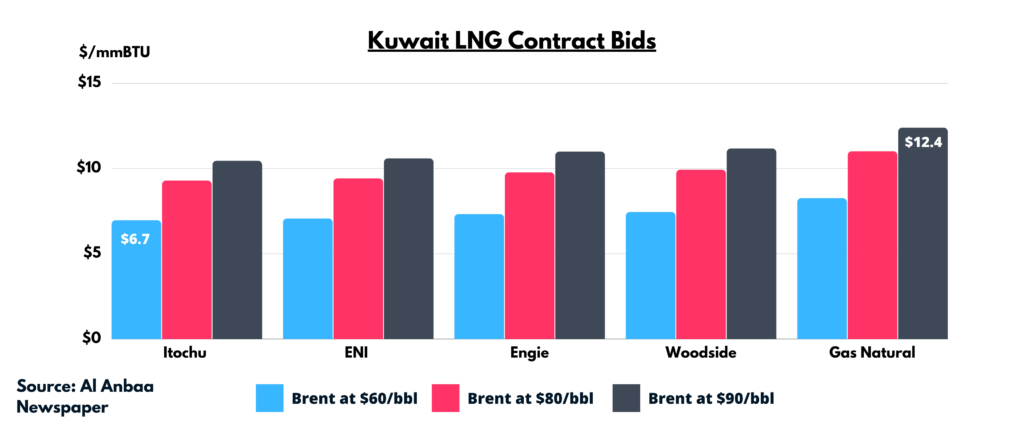

Reducing Natural Gas Consumption

By 2025, Kuwait will produce approximately 45% of its Natural Gas gas demand and import the remaining 55% through supply contracts with Qatar and Crude-oil linked contracts from other suppliers. The graph below shows recent bid prices for Kuwait’s Natural Gas import contract depending on 3 scenarios of oil prices.

Natural Gas prices are volatile and even once we start developing the Durra gasfield our cost of power generation will vary depending on the opportunity cost of selling the locally consumed capacity on the international markets.

Using Green Hydrogen in a blend with Natural Gas during times of high Natural Gas prices will reduce our energy costs and we can switch back to Natural Gas when the cost of the fuel is low.

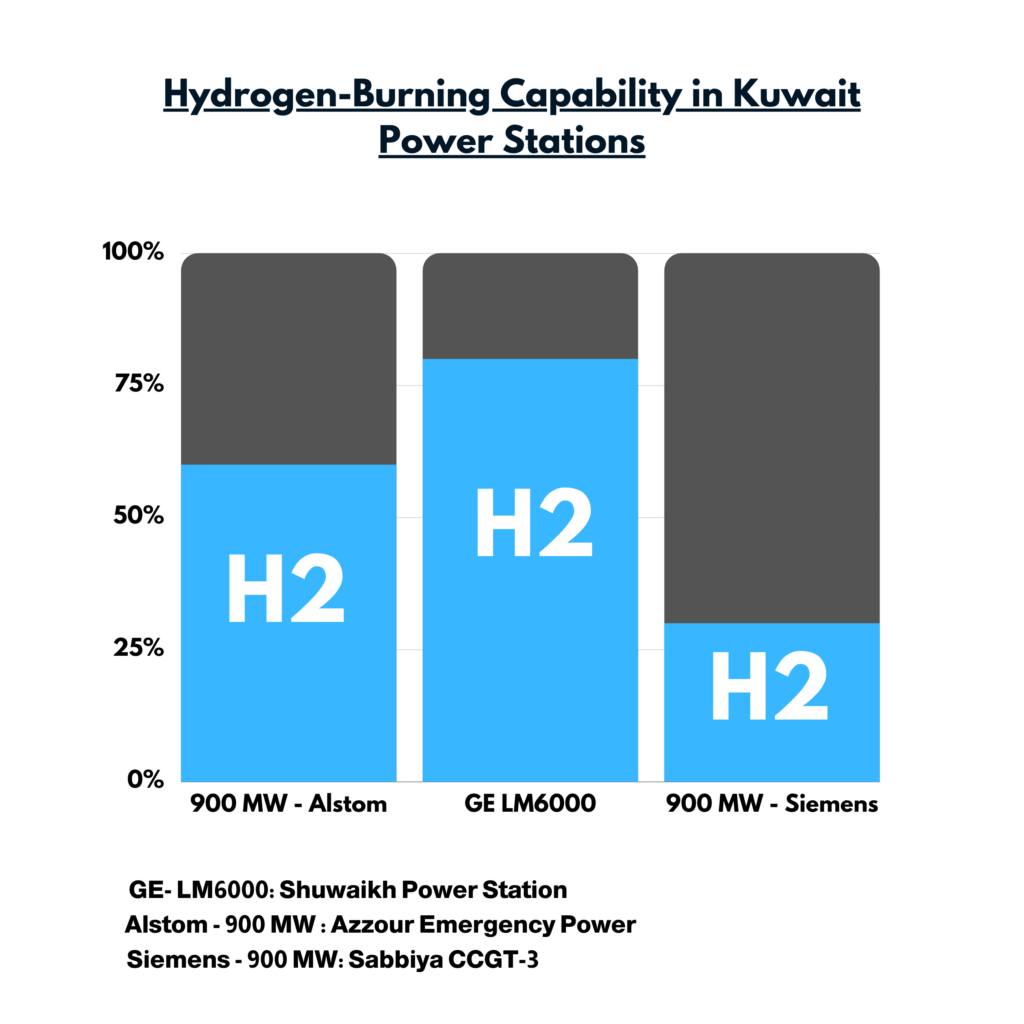

At the moment, some of the Gas turbines used in our already established power stations can use varying degrees of Hydrogen/Natural Gas blends.

When the cost of Natural Gas is high we can resell the Natural Gas in-storage on the international markets and profit from the difference in costs between NG and Green Hydrogen.

The Three Phases Proposal

Phase 1: Hydrogen Industry Pilot Program

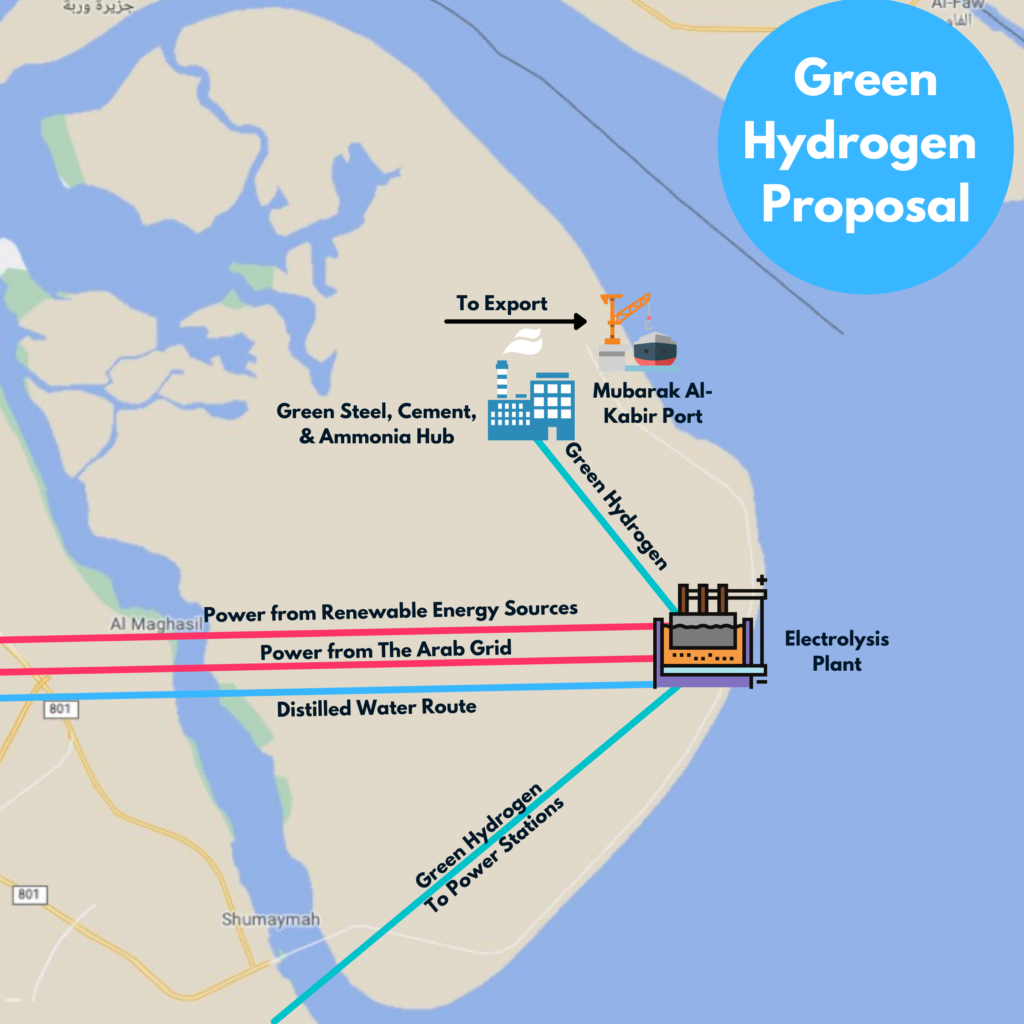

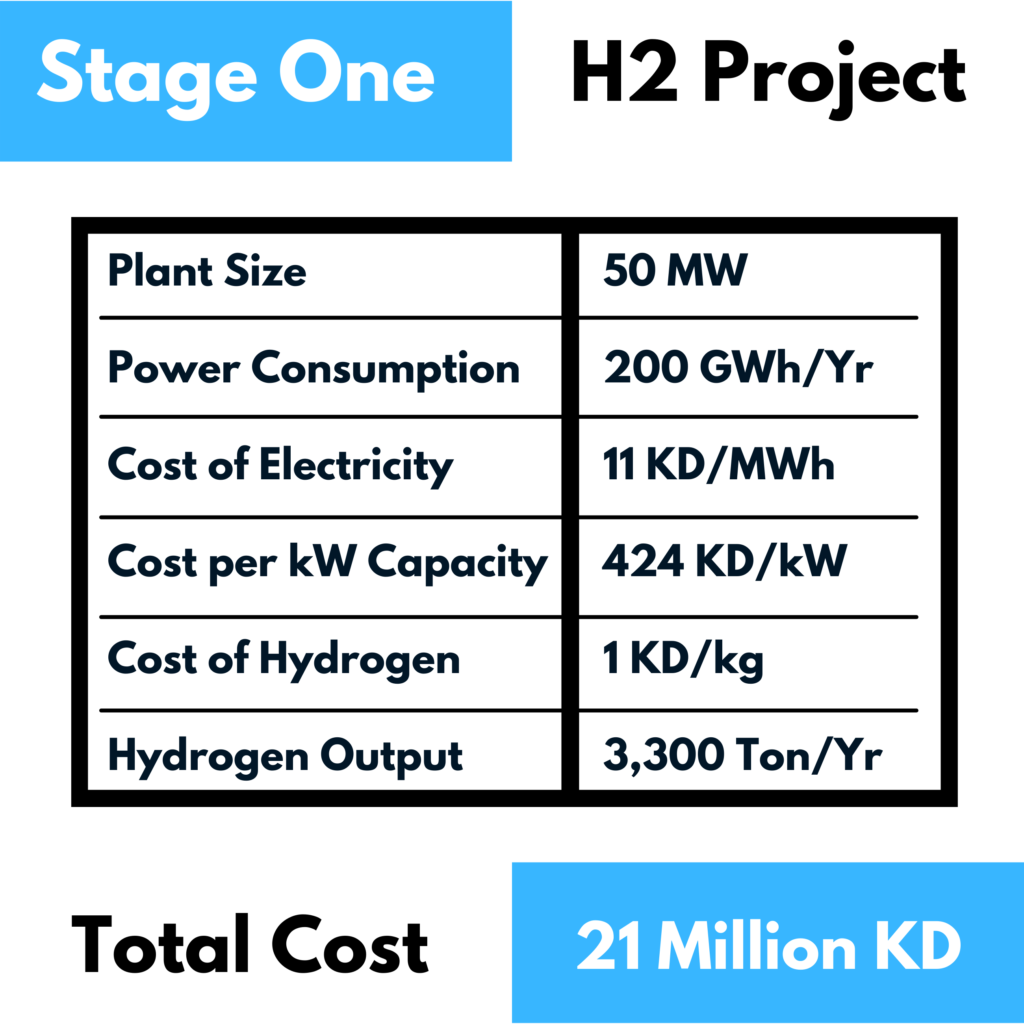

A 50 MW Electrolyzer installation will be able to provide Hydrogen for the pilot heavy industries and power generation programs.

Al Dibdibah PV project is expected to generate between 2,500 GWh/Year to 3,150 GWh/Year. The pilot program will require 200 GWh to produce 3,000 tons/year of Hydrogen at the price above $3.3 /kg. The facility will cost $1,400/kW, which translates to 24 million KWD ($79 million). The high starting cost is to account for location development and water supply costs.

Phase 2: Local Green Heavy Industries

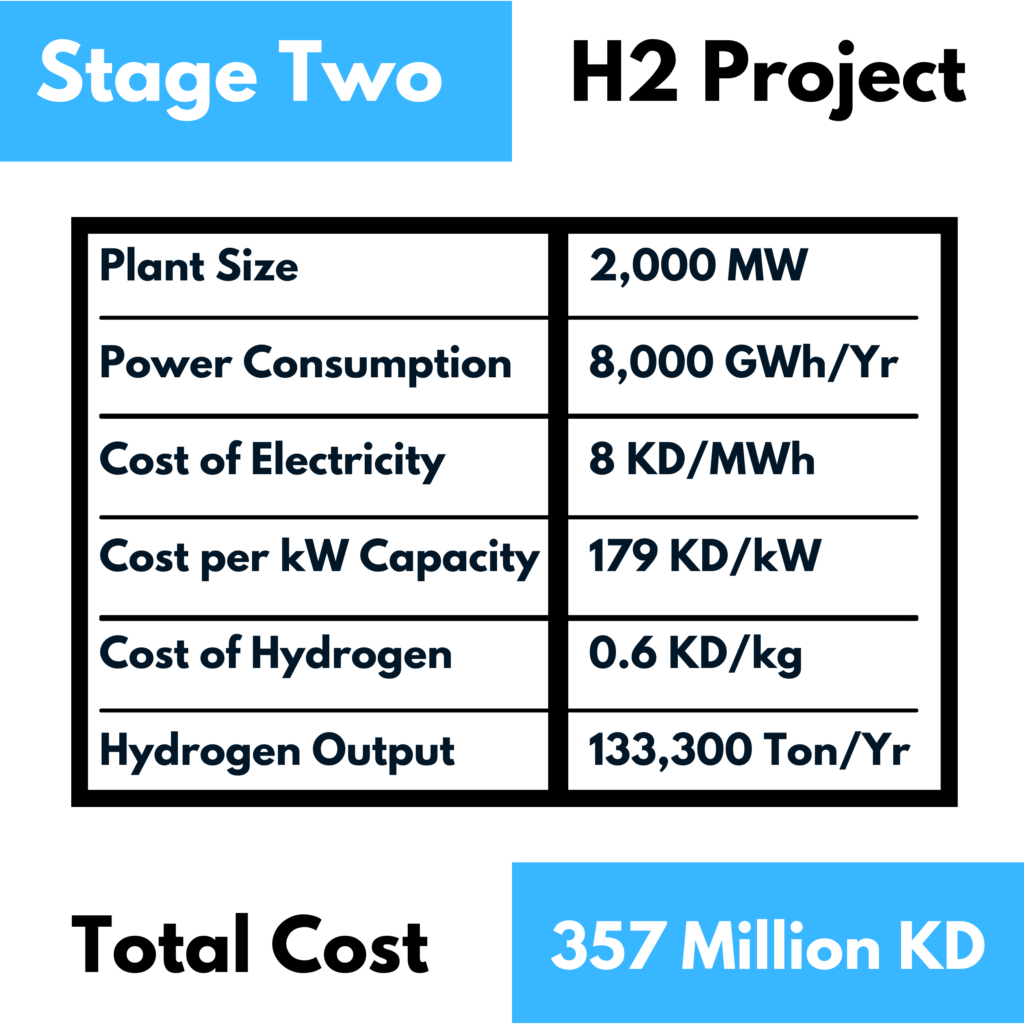

Prior to implementing the second phase, Kuwait will need to increase its renewable energy capacity to 5 GW. This can be a mixture of PV Solar, Wind, and other technologies. As a result, this will reduce the LCOE of our electricity and the cost of Hydrogen as well.

According to IRENA, the electrolysis costs can drop by 50% ( to $600/kW) once the system reaches 100MW in size. Therefore, for phase 2, I propose a 2GW Hydrogen project that will generate approximately 133K tons/year of Hydrogen, at 357 million KD ($1.2 billion) cost.

Phase 3: Expansion of Hydrogen Industry & Exports

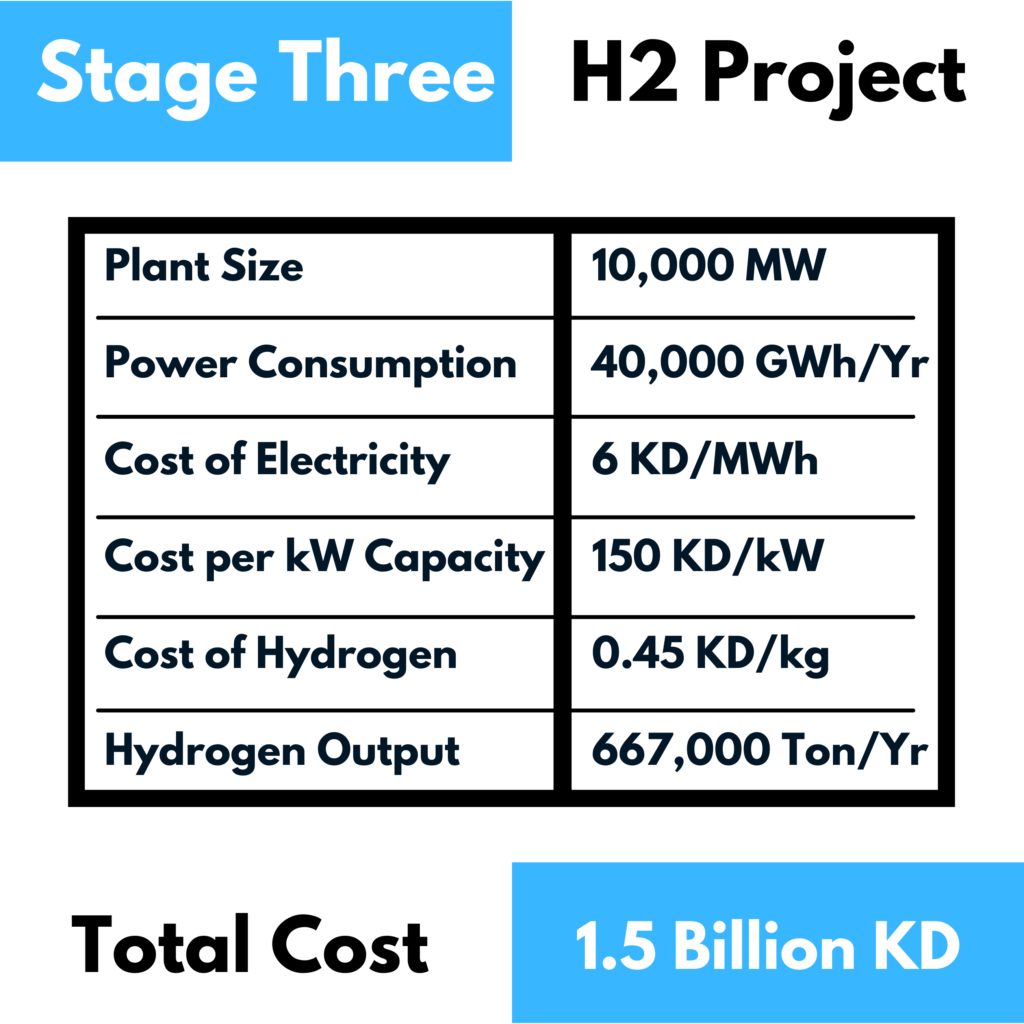

As Kuwait’s Electrolyzer capacity expands the cost of Hydrogen/kg will drop further to the below $2 range and allow Kuwaiti Hydrogen to compete more on the International markets.

Additionally, with the further expansion of the Arab Electrical Grid, our neighbouring countries can convert their excess power to Hydrogen and it can be either used by the heavy industries or converted into Blue/Green Ammonia and shipped to international buyers.

The Future

In my next article, I will outline how Kuwait can finance the ever-growing capacity of Renewable Energy while also reducing the subsidies it pays every year on power generation.

I really enjoy reading your articles but I think you need to focus more in ur DATA that you used in ur Analysis..

Also, you need to focus more on your business model and do the comparison between Saudi Arabia and Kuwait or UAE and Kuwait because this is the punch market in GCC that u need !!

Even the capacity and efficiency u need to bring more accurate numbers

GOOD JOB !!!

بحث ممتاز ممكن ان تراسلني على الايميل اخ احمد او على الواتس

واتس 971551979724

اتصال 971566363536

جهد متميز ودراسه جديره بالاهتمام

اذا ممكن نتواصل عن طريق الايميل